Paper trading on Webull: how to get started

Paper trading accounts are a great way to test out a trading platform and how it serves your investment strategies in a risk-free environment.

With paper trading, you’re given virtual funds to practice placing trades. There’s no real money involved, so you’re able to familiarize yourself with the markets and the platform’s features without risking your own capital.

In this article, we’ll review Webull’s demo account, one of the best free paper trading simulators, and provide a step-by-step guide that includes:

- Getting started – how to open a paper trading account with Webull

- Dashboard navigation – key features and tools available

- How to execute a trade – including different order types

- Monitoring and analyzing your trades

- Overall review

Trading exposes you to the risk of losing more than your initial investment and incurring financial liability. Trading is suitable only for well-informed, sophisticated clients able to understand how the products being traded work and having the financial ability to bear the aforementioned risk.

Transactions involving foreign exchange instruments (FOREX) and contracts for difference (CFD) are highly speculative and extremely complex. As such, they are subject to a high level of risk due to leverage. Please keep in mind that CDF trading is banned in the US.

Information published on the NewTrading.io website is for educational purposes only and should not be construed as offering investment advice or as an enticement to trade financial instruments.

Getting started with Webull

Webull is a US-based broker that offers access to stocks, ETFs, and options. It offers zero commission on stocks and ETFs along with various account types, including individual investment accounts, a traditional IRA, a Roth IRA, and a Rollover IRA. There are no minimum deposit requirements, and it also offers pre-market and after-hours trading on select stocks.

Signing up for a paper trading account via computer or laptop is fairly simple, although navigating to the paper trading account itself can be slightly confusing.

- Visit https://www.webull.com/paper-trading

- Click ‘Open an Account’ and enter your information (in this case, a phone number is required).

- Once you’ve verified your phone number, you’re taken into the Webull platform. However you’ll be in the watchlist section of the platform.

- At the left-hand side of your screen, navigate down to the paper trading section – a small dollar symbol within a square. You’ll now be ready to begin using the paper trading simulator.

Webull Paper Trading Dashboard navigation

Once you’ve opened your paper trading account, the navigation is fairly intuitive. Your dashboard contains your account details, a watchlist, a chart of your chosen instrument, volume analysis, and a section for your open positions. You’re able to customize the layout as you see fit; simply drag and drop each of the windows into your preferred order.

You can also switch between Webull’s light and dark themes—simply select settings from the left-hand navigation pane and choose your color scheme.

One of the first things to note about the dashboard is that it’s not immediately obvious that there are markets other than stocks to trade. The tab is labeled ‘US Stocks Paper Trading,’ and a chart of Apple’s stock price is displayed, which gives the dashboard a very stocks-centric feel.

However, you can search for other markets in the top right corner of the platform, where ETFs and options appear from the search bar. You can also find indices such as the NASDAQ, but they don’t appear to be tradeable on the paper trading account. To add any additional markets to your watchlist, simply click the star using the instrument’s symbol/name.

At the start, you’re given $1 million of virtual currency to invest in this paper trading account. This seems a little excessive from a psychological perspective – it’s hard to implement your own strategies when that’s not likely to be your initial deposit – but it does give you plenty of capital to become familiar with the platform and markets available to you.

Executing Trades on Webull demo account

To place a trade, first, find the instrument you’d like to invest in. Once you select it, open the deal ticket, which you’ll need to adjust before submitting your virtual order. You’re able to adjust whether you want to buy/sell, limit price, quantity, and trading hours. The deal ticket is located on the dashboard and will update as you select different markets.

You can also use some of Webull’s free tools within the platform to find your next investment idea. For example, you can open a stock page, check the news, find analyst ratings and technical analysis, or view a firm’s fundamentals, such as key indicators. The integrated newsfeed and the technical indicators are a useful feature to find your next investment opportunity.

Once you’ve chosen the market in which to trade, fill in the order ticket to your specifications – including the direction of the trade, position size, and order type. There are only two types of orders on the paper trading account: limit or market order. When you’re ready, click ‘Paper Trade’ to confirm your trade.

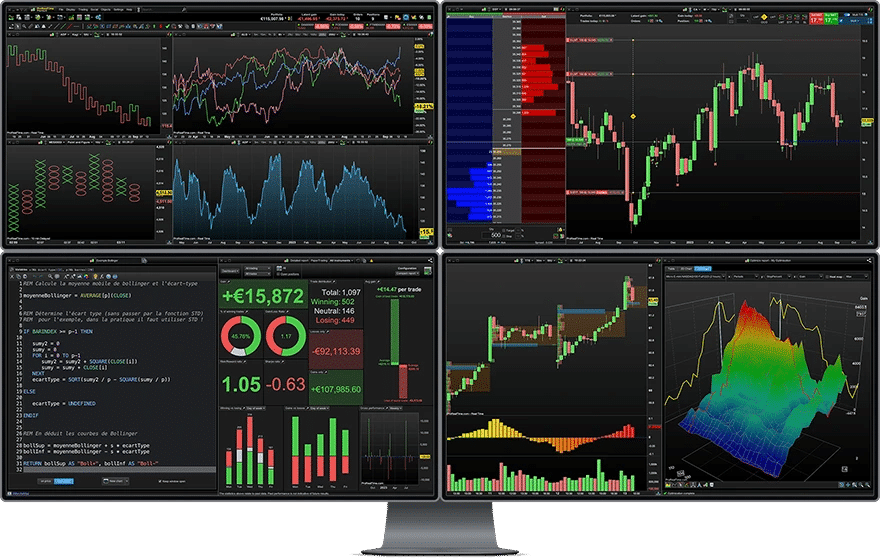

ProRealTime is a trading platform that delivers a comprehensive suite of charting software and technical analysis tools designed to help traders navigate the markets with precision.

With over 22 years of experience in the field, ProRealTime has garnered the trust of more than a million users worldwide. While there may be a bit of a learning curve, ProRealTime is undoubtedly the gold standard for trading platforms.

Monitoring and analyzing trades

Once you’ve placed your first trade, you’re able to open the position you hold and select the profit and loss summary to see your account’s profit/loss within the platform. Scroll up to see the components, proportions, and contributions of gains and losses to get a general view of your total investments.

You can also stay informed on your investments through Webull’s alerts. They offer several kinds of alerts here, including:

- Price alerts

- Volume alerts

- Analyst rating changes

- Macroeconomic news

Please note that to set alerts, you’ll need to have the Webull app installed. Alerts are not available through the desktop paper trading simulator.

Additionally, one downside to Webull’s paper simulator when it comes to monitoring or adjusting your positions is that the paper trading account lacks any stop loss/take profit features. Stop losses and take profit levels are used across trading accounts to lock in profits and limit losses, and they act as important tools for risk management and overall investment strategy. With Webull, however, these features do not seem to be available for the paper trading simulator, meaning that you’ll need to manage your positions manually.

Our take on Webull’s paper trading simulator

Overall, Webull has a slick interface for desktop and an intuitive mobile app, as well as a decent range of tools available to both beginner and intermediate investors, with an advanced charting package and a good screener tool. However, its lack of stop loss/take profit, as well as a limited availability of asset classes, makes it less than ideal for paper trading since basic features are missing that prevent you from fully testing investing strategies.

Maxime holds two master’s degrees from the SKEMA Business School and FFBC: a Master of Management and a Master of International Financial Analysis. As founder and editor-in-chief of NewTrading.fr, he writes daily about financial trading.

The ProRealTime trading platform combines powerful trading tools with attractive brokerage offers from a select few financial brokers. Here’s a.

Day trading isn’t a new phenomenon—it’s been around for over 150 years, dating back to the earliest days of the.